How to Choose the Right Mortgage Insurance in Singapore

This publication has not been reviewed by the Monetary Authority of Singapore

Terms of Use, Disclosure and Disclaimers

Homeownership is very common in Singapore, with 87.9% of households owning their homes (Source: Singstat). If you are reading this article, you are likely one of these homeowners and have an outstanding mortgage. Do you need mortgage insurance? And how can you save money in the long term?

TLDR:

– If you intend to stay in your HDB and never move => Stay with HPS

– If you want to save money by paying a lower premium => Shop for a cheaper Mortgage Insurance

– If you plan to upgrade your property in the future => Get a Level Term insurance

What is Mortgage Insurance?

Mortgage insurance, also known as Mortgage Reducing Term Assurance (MRTA), is a type of life insurance that pays off your mortgage if you die or become totally and permanently disabled (TPD). This can help your family avoid financial hardship if you are no longer able to work and make mortgage payments.

In the event of death or total and permanent disability (TPD), mortgage insurance will pay out a lump sum that is equal to the outstanding balance of your mortgage. This can help your family or beneficiaries pay off the mortgage and keep your home.

Why is Mortgage Insurance important?

If you have an outstanding home loan, what happens when you pass away? Will your family be able to take over the duty of paying the outstanding mortgage? Can they meet the Total Debt Servicing Ratio (TDSR) limit?

If your family is unable to take over the repayment of the outstanding mortgage, what happens to their home?

Your home is likely to be one of the most important assets that your family has. Responsible providers will want to make sure that their families will still have a roof over their head when they pass away.

Mortgage Insurance will ensure that their family will not face the financial burden of repaying the outstanding mortgage (which can amount in the millions).

Protect your Family with Term Insurance

Get a $1,000,000 term insurance policy for $38.80 per month.

(Male age next birthday 30, non-smoker, cover for 30 years)

What are the types of Mortgage Insurance?

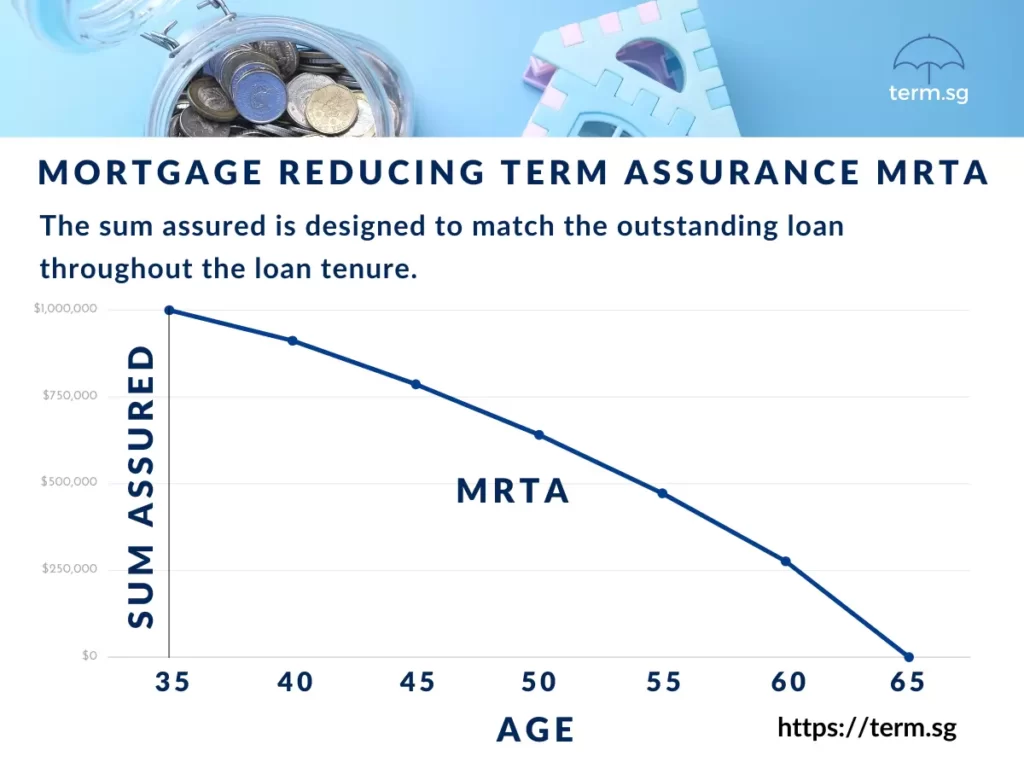

MRTA is a type of mortgage insurance that provides a decreasing death benefit. This means that the amount of insurance you need decreases over time as your mortgage balance decreases. The sum assured will eventually reach zero when the policy expires. This is because the insurance is designed to match the outstanding loan amount throughout the loan tenure.

HDB owners should be familiar with the Home Protection Scheme (HPS). HPS is an example of an MRTA. It is compulsory to have HPS if you use your CPF-OA for loan repayments. You can apply for HPS exemption if you have the following insurance policies:

These policies must cover your outstanding housing loan up to the full term of loan or until you turn 65, whichever is earlier. (source: CPF)

Here are some ways to save money with a private MRTA instead of HPS

For most people, HPS is the default mortgage insurance unless they take the effort to look for an alternative. Let’s see how we can save money by getting a private MRTA instead of HPS.

Scenario: a 40 year old male non-smoker with a loan amount of $600,000 for 25 years.

HPS costs $851.40 per year (source: HPS calculator)

A private MRTA can cost as low as $643.80 per year.

A simple, one-time paperwork can potentially save you > $4,000 over the next 20+ years.

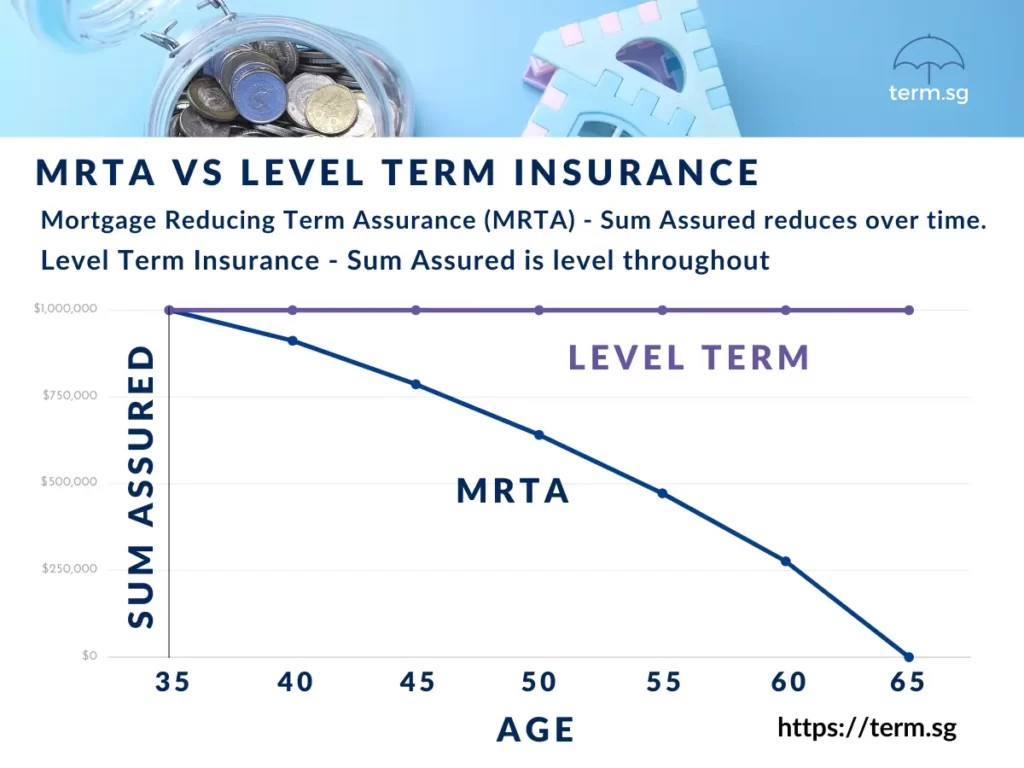

What is the difference between MRTA and Level Term

Level Term / Term Life Insurance differs from MRTA because the sum assured stays level. This means that, if you started with a $1,000,000 sum assured, it will stay at $1,000.000 until it expires.

With MRTA, the sum assured decreases over time as your mortgage balance decreases. This is because MRTA is designed to cover the outstanding balance of your mortgage, and the outstanding balance decreases over time as you make payments.

Assuming the same conditions, a 40-year-old non-smoking male with a $600,000 home loan for 25 years can get a Level Term plan for as low as $816.45 per month. This means that you can get better coverage for less than the Home Protection Scheme (HPS) premium!

Get a quotation for your age and sum assured by inputing your info here:

Compare Quotations from 10+ Insurers With Just 1 Click

You only need 2 minutes to input your details.

Fast & reliable online application.

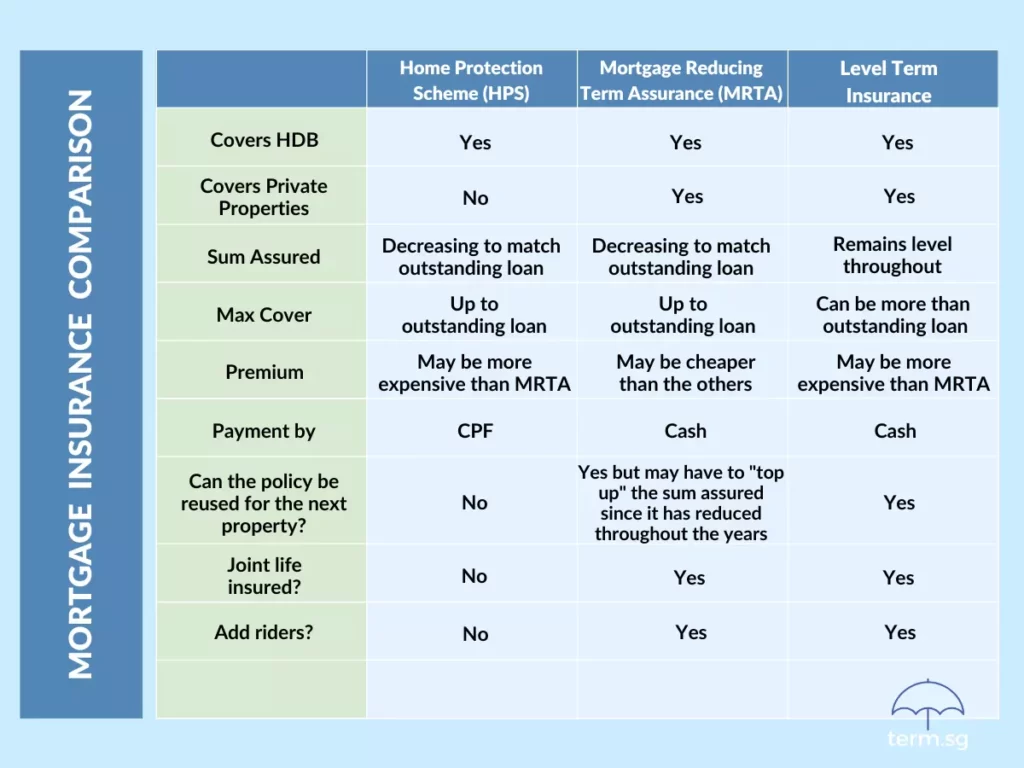

Mortgage Insurance Comparison: HPS vs MRTA vs Level Term

Most Singaporeans start off with an HDB flat and use CPF for payment. By default, HPS is needed unless they apply for an exemption.

One of the limitations of the HPS is that it cannot be transferred to a new property. If you decide to move home, you will need to purchase a new HPS or MRTA or Level Term policy, and the premium will be based on your age at the time of purchase.

As you get older, the cost of life insurance policies increases. This is because the older you are, the more likely you are to die, and the more expensive it is for the insurance company to pay out a death benefit.

Additionally, as you get older, you are more likely to have health conditions, which can also make it more expensive to get life insurance. In some cases, you may not be able to get life insurance at all, or you may have to pay a higher premium.

If you are planning to upgrade your home in the future, it may be a good idea to choose a level term policy instead of HPS. Level term policies offer a fixed premium for a set period of time, so you can lock in a low rate when you are young and healthy. This can save you money in the long run, especially if you need to take out a new mortgage when you upgrade your home.

How a Level Term Plan can help you save money in the long term

An illustration

John is a 30 year old male non-smoker. The premium for John for a $1,000,000 Level Term insurance to age 65 is $615 per year. This $1,000,000 sum assured and premium stay level throughout the policy.

When John buys his 4 room BTO with his wife, Jane, he can use this Level Term policy to get an exemption for HPS (Provided his loan is less than $1,000,000 and loan tenure is not longer than age 65).

10 years later, at age 40, John and Jane bought a bigger resale flat near a top school to cater to their 2 children. As long as the loan taken up is less than $1,000,000 and the tenure is not longer than age 65, the Level Term insurance he bought 10 years ago is still effective as a mortgage insurance. The premium remains at $615 per year.

For comparison, an HPS for $600,000 from age 40 to age 65 is $851.40 per year (source: HPS calculator)

10 years later, at age 50, John and Jane upgraded to a condo. As long as the loan taken up is less than $1,000,000 and the tenure is not longer than age 65, the Level Term insurance he bought 20 years ago is still effective as a mortgage insurance. The premium remains at $615 per year.

For comparison, a MRTA for $1,000,000 from age 50 to age 65 is $1,635 per year.

Not only is the premium more expensive, John may not get insured at standard rate or may even get declined if he has health conditions (eg, hypertension, high cholesterol etc).

Therefore, it makes sense to get a Level Term policy when you are young and healthy to “lock in” the low premium. This can be re-used again and again as your mortgage insurance throughout your lifetime. Do take note to have sufficient sum assured for future properties.

Another advantage of a Level Term insurance is that the sum assured does not reduce, unlike an MRTA. For example, If a claim is made 10 years later, an MRTA will only pay a lump sum equivalent to the outstanding loan.

On the other hand, the level term policy will pay a lump sum equivalent to the initial sum assured ($1,000,000 in John’s case). This allows the insured family to pay off the outstanding loan and still have excess funds for their financial needs (eg. education, living expenses etc).

Happy Customers

What our clients have to say:

How much does mortgage insurance cost?

Factors affecting the cost of mortgage insurance:

Example for $1,000,000 sum assured:

John, age 30, non-smoker, deskbound occupation cover to age 65 => $615 per year

Jane, age 30, non-smoker, deskbound occupation cover to age 65 => $535.65 per year

Level Term policies are getting cheaper due to competition. With all the additional benefits of a Level Term plan, it is wise to shop around to find the right policy because insurers adjust their pricing from time to time. Compare Level Term insurance from >10 insurers here. It only takes 2 minutes to input your details:

Protect your Family with Term Insurance

Get a $1,000,000 term insurance policy for $38.80 per month.

(Male age next birthday 30, non-smoker, cover for 30 years)

Leon Lim (Indra Julie)

Leon is a Certified Financial Planner with over 15 years of experience in the finance industry. Leon is passionate about helping PMEBs (Professionals, Managers, Executives, and Business Owners) achieve their retirement goals and attain financial freedom.