When Should I Get Life Insurance?

This publication has not been reviewed by the Monetary Authority of Singapore

Terms of Use, Disclosure and Disclaimers

If you are thinking about life insurance, you might wonder when is the best time to get it. The answer to that question depends on several factors. This includes your age and health, your family’s needs, and your financial situation. Let’s take a closer look at each of these factors to help you decide when is the best time for you to get life insurance.

What is life insurance?

Life insurance is a type of financial protection that provides a financial benefit to your loved ones if you pass away. It can help cover their expenses and provide them with financial stability in the event of your death. It can also help to pay off debts, such as a mortgage, and provide money for final expenses like funeral costs. It is important to remember that the best time to buy life insurance is when you are healthy and have dependants who rely on your income.

Do I need insurance if I have no dependants?

Some people believe that if they have no dependants, they do not need life insurance. However, this is not always the case. If you have debts, such as a mortgage, car loan, or credit card debt, life insurance can help your loved ones pay off these debts if you pass away. Life insurance can also help to pay for final expenses, such as funeral costs.

Why should I buy life insurance when I am young and healthy?

Do you need to get life insurance when you are in your 20s? 30s? It depends. One of the main reasons to purchase life insurance when you are young and healthy is that premiums are often less expensive when you are younger.

Additionally, if you are healthy, you are more likely to qualify as a “standard life” for any policy. Younger people also have more years to accumulate the cash value of their whole life policies. Thus, if you are young and healthy, purchasing life insurance can be both cost effective and a sound financial decision.

While life insurance can be a wise investment when you are young and healthy, it can be particularly difficult to buy if you are older and/or have a health condition. If you have a pre-existing condition, it can be more difficult to qualify as a “standard life”.

Protect your Family with Term Insurance

Get a $1,000,000 term insurance policy for $38.80 per month.

(Male age next birthday 30, non-smoker, cover for 30 years)

What are the consequences if I delay buying insurance for too long?

There is no rule that says you have to buy your insurance policy at a certain age. A young person who started working will neither have dependants nor much debt. While technically there is no need for a young person to get life insurance, it may be unwise or even risky to put it off for too long. Here are the top 3 reasons why:

More expensive premium

The longer you delay, the higher the premium. Let’s look at the following example.

- Male non smoker

- Term insurance to age 65

- Death benefit of $1,000,000

- TPD benefit of $1,000,000

- CI benefit of $300,000

If you were to get the coverage at age 25, your premium is only $71.76 per month. Every year that you delay comes at a cost of 5.67% increase on average.

Compare Quotations from 10+ Insurers With Just 1 Click

You only need 2 minutes to input your details.

Fast & reliable online application.

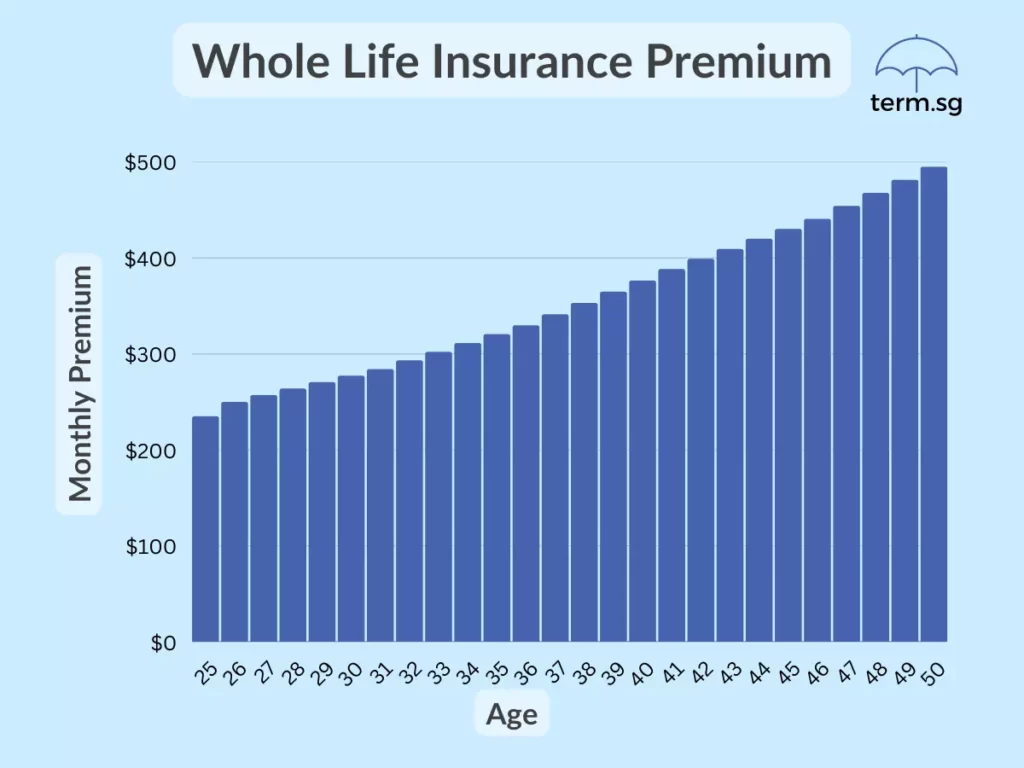

Let’s look at an example for whole life insurance.

- Male non smoker

- Whole Life insurance

- Death benefit of $100,000

- TPD benefit of $100,000

- CI benefit of $100,000

- 3X multiplier to age 70

- 20 year premium term

If you were to get the coverage at age 25, your premium is only $234.75 per month. Every year that you delay comes at a cost of 2.95% increase on average. In addition, If you were to start older, your cash values will have a shorter time to accumulate and grow.

Nobody likes to pay more to get the same product, let alone paying more to get a worse product. This is what may happen if you delay too long:

Higher chance of being denied a standard policy

One of the possible risks of delaying for too long is NOT being accepted as a “standard life”. Certain health conditions may make it expensive or impossible to get a life insurance policy. It is important to already have an insurance policy before developing any medical conditions (ie. buy when you are healthy).

Moreover, it is very common to have 1 or more of these conditions as one get older:

- Hyperlipidaemia (33.6%)

- Hypertension (21.5%)

- Diabetes (8.6%)

- Obesity (8.7%)

Prevalence among adults aged 18 to 69 years 2017. Source: MOH

Here are the possible consequences of applying for insurance when you already have a pre-existing condition:

- Loading – The insurer may require an extra premium to cover you. A policy which normally costs $2,000 may cost you $4,000 or even $6,000. You may be paying double or triple what others in your age group are paying.

- Exclusion – The insurer will not cover you if the claim made is related directly or indirectly due to the pre-existing condition(s).

- Decline – The insurer rejects your application.

The worst case scenario is when you fall seriously ill without any insurance. And due to the illness, you are also unable to get any coverage for the rest of your life. You need to consider this risk when deciding when you should get an insurance policy.

Letting your loved ones bear the financial burden

Anyone with dependants is taking a huge risk if they do not have adequete life insurance. It is a tragedy If a person dies and their loved ones have to sell their home or dig deep into their savings to make ends meet. This is the true cost of delaying your life insurance coverage.

This could have been avoided if they have an affordable term insurance policy. Once you have loved ones who are dependant on you (eg. a newborn child), it is important to stop delaying and get yourself covered.

In most cases, we buy insurance not for ourselves but for our loved ones.

Conclusions | TL;DR

You can only buy insurance when you are still healthy. It also makes sense to buy when you are younger because premiums are cheaper. Delaying can have dire consequences for your loved ones.

If you are on a tight budget, you can consider buying an inexpensive term policy with a feature that allows you to increase the sum assured in the future without underwriting. For example, a policy with $1,000,000 sum assured for death and TPD for a 30 year old male (cover to age 60) is only $38.80 per month.

Lock in your insurance coverage before it is too late.

Protect your Family with Term Insurance

Get a $1,000,000 term insurance policy for $38.80 per month.

(Male age next birthday 30, non-smoker, cover for 30 years)

Happy Customers

What our clients have to say:

Leon Lim (Indra Julie)

Leon is a Certified Financial Planner with over 15 years of experience in the finance industry. Leon is passionate about helping PMEBs (Professionals, Managers, Executives, and Business Owners) achieve their retirement goals and attain financial freedom.